| Home | Community | Arts/Theater | Business | Economy - Local | The Scene | Industry |

| Agriculture | Kid's Korner | GRAFF SPORTS | Jr. Football | Politics | ||

Issue 555

October 19, 2008

(Prior Story) Business ArTicle 3180 (Next Story)

Sponsored by Bay Area Chamber of Commerce

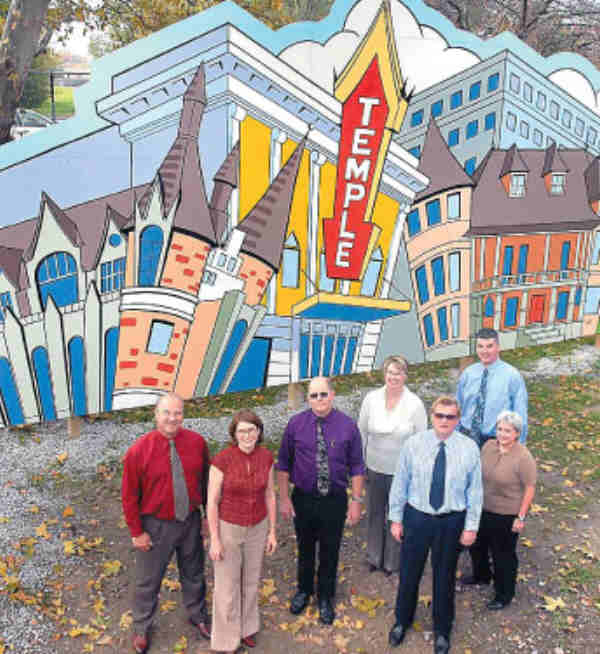

Morley Companies, Inc., officials show off the company display at the Saginaw Zoo. Saginaw Project Among Dozen OKd by Michigan Economic Growth Authority

|

||||||||||

| Printer Friendly Story View |

The Michigan Economic Growth Authority (MEGA) board last week approved 12 projects estimated to bring over 7,500 new jobs and $489 million in new investment to the state.

A Saginaw firm, Morley Companies, Inc., received $2.8 million in state tax credits toward a $1.7 million project to expand its data processing business, adding up to 350 new jobs.

Two of the companies looking to expand in Michigan cited tax incentives provided through the Michigan Economic Development Corporation (MEDC) as factors in their moves.

"It seems that this MEGA board refuses to participate in this recession," joked MEDC President and CEO James Epolito, noting that in its 13-year history, the board has approved a record number of project this year.

(NOTE: Mr. Epolito is slated to speak to the Rotary Club of Bay City Oct. 28. Contact a Rotary Club member if you wish to attend.)

Gov. Jennifer Granholm said the number of direct jobs from the nine bids is about 2,500 while an additional 5,000 jobs would be "spin-offs" from the business expansions.

John Morgan, vice president of United Solar Ovonic (USO), said that the expansion his company is planning with the help of the MEGA tax credits will give them the available infrastructure to cut lag time between hiring and training workers.

He said the company is unable to build facilities and train workers fast enough, costing the firm $5 million a week.

USO, planning to build a new solar-cell facility in Battle Creek that will directly create 350 new jobs, received $17.3 million in state tax credits over the next 20 years. MEDC estimates that the USO construction will create 3,062 "spin-off" jobs.

"This is a watershed moment, what you're doing," said Department of Labor and Economic Growth Director Keith Cooley.

Projects also approved include:

- Advanced Defense Vehicle Systems Corporation, Orion Twp., a military personnel carrier producer, plans to invest $5.4 million in expanding its production facility. The investment is estimated to create 520 new jobs, with 223 directly created. The company received $5.6 million in state tax credits over the next 10 years, including several other tax incentives at the local level.

- Morley Companies Inc. -- The survey and data-reporting company, located in Saginaw Twp., plans to invest $1.7 million to support a new data-reporting project. The investment will create 90 new jobs for the company and up to 350 new jobs at the company's headquarters in Saginaw. Morley received $2.8 million in state tax credits over the next five years, in addition to other local tax credits.

- NetEnrich -- An IT-service provider based out of Silicon Valley, CA, plans to invest $2.7 million to construct a new operations facility in Washtenaw County, though no specific location has been chosen. The project is estimated to directly create 225 jobs and 435 jobs overall. The MEGA board approved $3.9 million in state tax credits over the next 10 years. The tax credits helped induce the company to locate in Michigan rather than Florida or South Carolina, two other locations the IT company had previously been considering.

- Reino Linen Service, Inc -- The Ohio-based medical-linen company plans to invest $11.5 million to expand its operations to Michigan in Brownstown Twp. Reino, whose expansion is estimated to directly create 315 new jobs and 445 new jobs overall, has provided linens to many Michigan facilities for the last 25 years and currently has a contract with St. Johns Health Company. The board approved over $600,000 in state tax credits over five years, as well as other local tax incentives within the township.

- JCIM US, LLC -- Located in Frenchtown Twp., Romulus, Lansing and Port Huron, the interior automobile component supplier plans to invest $4 million to expand its production facilities, creating approximately 325 new jobs. The board approved $3.37 million in state tax credits over the next ten years, keeping the company from relocating their facilities in Kentucky or Alabama.

- Hagerty Insurance Agency, Inc. -- The Traverse City insurance company, specializing in insuring classic cars and wooden boats, outlined a plan to invest $7 million to expand its operations, creating 226 and 386 new jobs, directly and overall. The MEGA board approved $2.2 million in state tax credits for up to seven years as well as $150,000 in job training funds for the expansion.

- City of Sturgis -- This brownfield redevelopment project will redevelop two Kirsch properties in Sturgis, MI, for both residential and commercials properties. State and local tax capture for the project is estimated to be $1.7 million, with the project estimated to generate $8.6 million in new capital investment and up to 100 new jobs.

- Mason County -- The renovation of the Ludington "fire barn" in downtown Ludington, MI, will transform the space to serve as the Michigan office for Western Land Services, Inc. Between state and local tax captures approved for the project, it will "capture" $504,638 and is estimated to generate $8.3 million in new investments and create 40 new jobs.###

| Printer Friendly Story View |

|

|

Dave Rogers |

|

|

|

Printer-Friendly Story View

0200 Nd: 11-09-2024 d 4 cpr 1

12/31/2020 P3v3-0200-Ad.cfm

SPONSORED LINKS

12/31/2020 drop ads P3v3-0200-Ad.cfm